- Select Transfer Money

- Select Wallet to Bank Transfer option

- Enter the bank details and amount

- Click on Send Money

- An OTP will be sent to your registered mobile number

- Verify the OTP

- Money will be transferred to the specified Account number

HIGHLIGHTS

Mobi-Kwik Wallet lets you send up to Rs. 20,000 a month to bank accounts

To send more, you need to get KYC done for the Mobi-Kwik account

As of now, there are no charges to transfer money from MobiKwik to bank

Mobi--Kwik is among the most popular digital payments platforms in India and has seen tremendous growth in user base and transactions ever since the demonetization of Rs. 500 and Rs. 1000 notes. The mobile wallet company says it has 35 million users and over 100,000 merchants on the platform, providing consumers a way to pay for goods without worrying about the shortage of cash. Just like rival Paytm, Mobi-Kwik also allows users to transfer money from their Mobi-Kwik wallet to their bank account.

Mobi-Kwik to bank transfer charges Post demonetization, Mobi-Kwik has made it free to transfer money from your wallet to the bank account. Earlier, the digital wallet company used to charge 4 percent for a non-KYC compliant user and 1 percent fee for a KYC compliant user.

How to transfer from Mobi-Kwik wallet to bank account

The question on many users’ minds is how to transfer their money from Mobi-Kwik to bank accounts. The process is quite simple actually. To transfer money from your Mobi-Kwik wallet to bank account, follow the steps belowing

Transfer money from Mobi-Kwik wallet to bank account using app

1. Open the app and tap the Pay or Transfer Money option

2. In the following menu, select the New Bank Transfer option

3. Provide the amount, account name, account number, and IFSC code in the require fields, and hit the Continue button

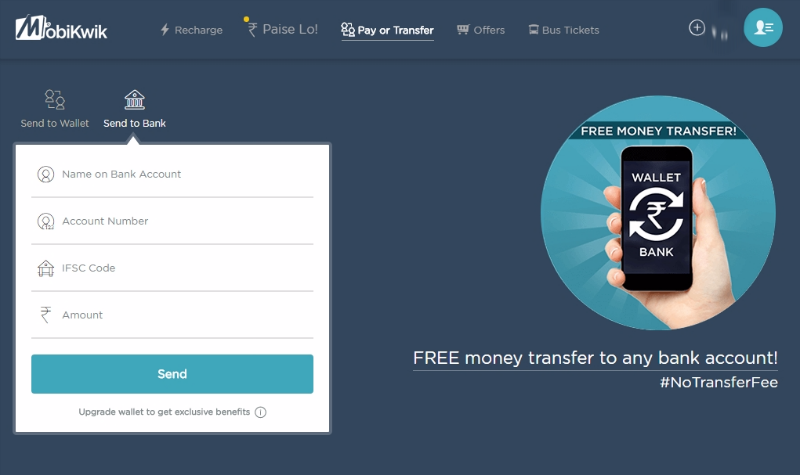

Transfer money from Mobi-Kwik wallet to bank account using Mobi-Kwik website

Open the www.mobikwik.com website and login to your account- Click on the Pay or Transfer tab on top of the screen

- Choose the Send to Bank option

- Type in the bank name, account number, IFSC code, and amount, and click the Send button

- You'll receive an OTP on your phone, enter this and click on Confirm

Under the PPI norms that mobile wallets have to comply with, Mobi-Kwik has a balance limit of Rs. 20,000, which is the limit of what you can transfer to your bank at any time. As an added measure, the limit for money you can transfer to your account is only Rs. 1,000 at a time.

However, you can carry out the KYC (know your customer) process to raise these limits. To do so, just choose the Upgrade your account option in Mobi-Kwik, and you can apply for KYC. The company sends someone to your house to collect the documents, and promises that the KYC will be completed in 48 hours.

After completing the KYC, you can store up to Rs. 1 lakh in the wallet, and transfer Rs. 5,000 to your bank at a time. There are no limits on how much money you can move to your bank account, after KYC.

Check out our similar guides for Paytm and FreeCharge.